“India’s GDP progress in Q1FY23 was 13.5%. At this fee, India is more likely to be the quickest rising financial system within the present fiscal,” the report stated.

The truth is, SBI estimates that India would be the third largest financial system by 2029. “The trail taken by India since 2014 reveals India is more likely to get the tag of third largest financial system in 2029, a motion of seven locations upwards since 2014 when India was ranked tenth. India ought to surpass Germany in 2027 and probably Japan by 2029 on the present fee of progress. This can be a exceptional achievement by any requirements,” stated Dr Soumya Kanti Ghosh, group chief financial adviser, State Financial institution of India.

Nevertheless, whilst estimates of India’s GDP progress fee for FY23 presently vary from 6.7% to 7.7%, SBI economists consider that it’s immaterial. “In a world that’s ravaged by uncertainties, we consider 6% -6.5% progress is the brand new regular,” they famous.

Different brokerages cite related views

In accordance with a report by HDFC Mutual Fund, India has been persistently tagged because the fastest-growing main financial system up to now few years by multilateral businesses such because the Worldwide Financial Fund (IMF).

A report by Morgan Stanley final month stated that India is more likely to be the fastest-growing Asian financial system in 2022-23. The brokerage expects India’s gross home product (GDP) progress to common 7 per cent throughout this era – the strongest among the many largest economies – and contributing 28 per cent and 22 per cent to Asian and international progress, respectively. The Indian financial system, they stated, is ready for its greatest run in over a decade, as pent-up demand is being unleashed.

“Now we have been constructive on India’s outlook, each from a cyclical and structural perspective, for a while. The current sturdy run of knowledge will increase our confidence that India is properly positioned to ship home demand alpha, which might be notably necessary as developed market (DM) progress weak spot percolates into Asia’s exterior demand,” stated Chetan Ahya, chief Asia economist at Morgan Stanley in a be aware.

Decrease debt in comparison with remainder of the world

In comparison with the remainder of the world, India has a lot decrease debt within the financial system, famous HDFC MF. “India is among the many few economies to have debt decrease than the beginning of the worldwide monetary disaster,” it stated.

Demographic dividend, younger inhabitants

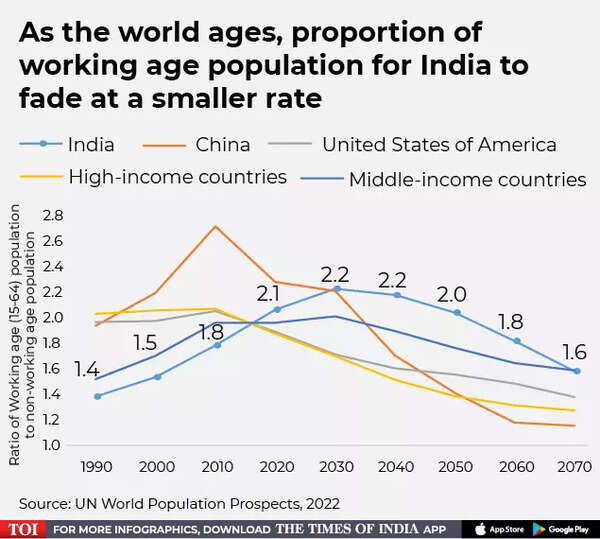

India’s inhabitants dimension is anticipated to exceed China by 2023, with every counting greater than 1.4 billion residents this 12 months, in line with a United Nations report. In 2022, India’s inhabitants will solely be barely decrease (at 1.412 billion) than China’s (1.426 billion), in line with the report.

And in 2050, the nation is projected to have a inhabitants of 1.668 billion – approach forward of China’s 1.317 billion.

Whereas the world is anticipated to see an ‘ageing’ pattern, India will proceed to have the next share of working age inhabitants.

In accordance with the SBI report, Chinese language demographers at the moment are predicting that adverse inhabitants progress in China would be the dominant pattern within the coming years for a very long time and bettering the general high quality of the inhabitants and altering financial improvement plans are important to handle the issue.

With ageing, the scale of the household will step by step shrink. The housing demand will ultimately decline in the long term in China as seen in Japan, the report highlighted.

“Sooner or later outlook of the development sector in China over the long term structural elements resembling demographic ageing and rebalancing of the financial system will ultimately take away a considerable portion of demand,” it stated.

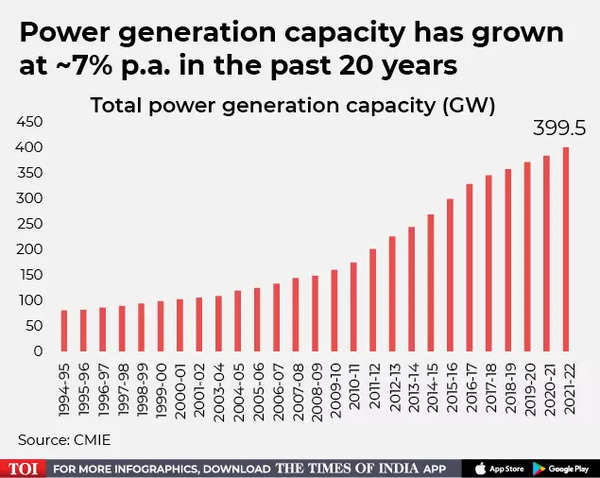

Entry to vital infrastructure improved

India has massively improved entry to fundamentals resembling:

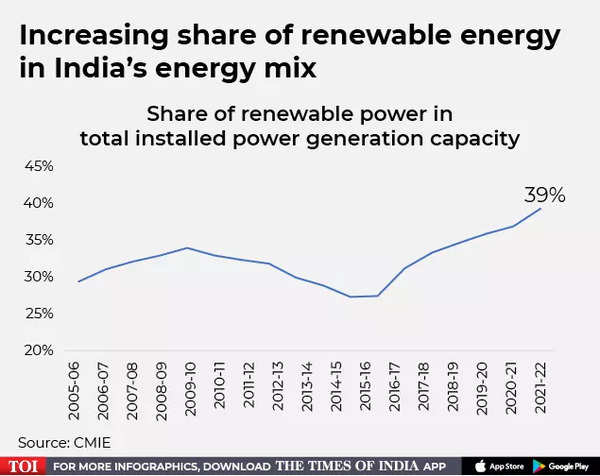

India can be including inexperienced power capacities

As a part of the nationally decided contributions to the United Nations Framework Conference on Local weather Change, India has set a goal of fifty% cumulative electrical energy put in capability from non-fossil fuel-based power sources by 2030.

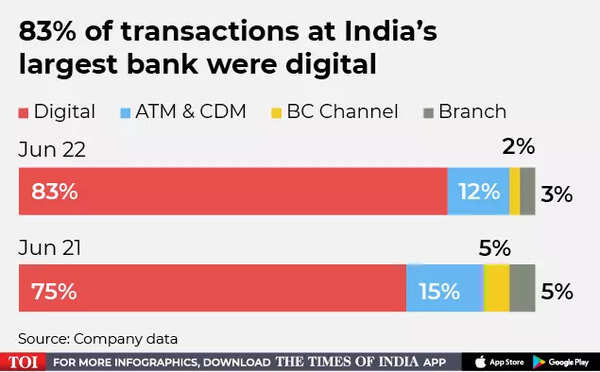

Whereas greater than 60% of the inhabitants is now linked to the web

India is main the world when it comes to digital funds. Almost 60% of all digital funds are presently UPI-based. The widespread use of smartphones, reasonably priced web connectivity, and India’s biometric identification card all contributed to the explosive progress of on-line funds by way of cell phones.

PwC tasks that between 2020 and 2025, there might be 1.9 billion cashless transactions, and that determine might probably triple by 2030.

FPI flows have turned optimistic

Massive outflows had been witnessed from international portfolio buyers from October 2021 onwards as economies internationally started mountain climbing the rates of interest, making it costlier for international buyers to put money into rising market economies. They abated in July 2022, and have turned optimistic in August 2022. FPI flows in August 2022 stood at roughly Rs 60,000 crore.

Indian equities had been among the many largest recipients of abroad flows in August, exhibits Bloomberg knowledge.