has pledged his whole stakes in Ambuja Cements and in ACC, value about Rs 96,800 crore, with Deutsche Financial institution’s Hong Kong department, inventory alternate disclosures confirmed.

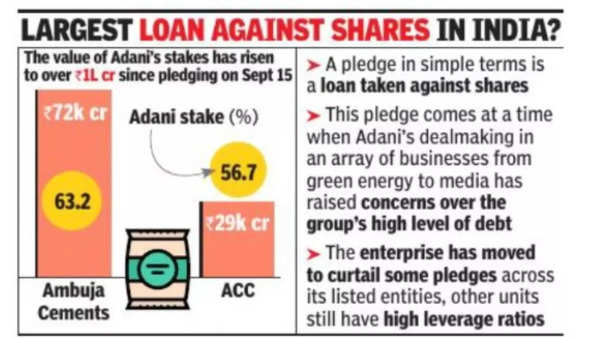

Adani owns 63. 2% in Ambuja and 56. 7% in ACC (of which simply over 50% is held by way of Ambuja). Each the pledges, referred to as ‘encumbrances’ in technical parlance, aimed toward elevating funds, had been created on September 15 and the stakes had been value about Rs 96,800 crore on that date. Ambuja and ACC’s shares had closed at Rs 539 and Rs 2,748 on the BSE on September 15.

Adani had acquired Ambuja and ACC by way of a Mauritius-incorporated entity, Endeavour Commerce and Funding, which in flip is owned by one other Mauritius-incorporated firm Xcent Commerce and Funding.

The inventory alternate disclosures for each the pledges on Tuesday stated Endeavour and Xcent have borrowed underneath facility agreements dated July 25 and notice belief deeds dated September 9 with Deutsche Financial institution’s Hong Kong department. Beneath sure deeds of fastened and floating cost, over 100% shares in Endeavour and Xcent have been created in favour of the financial institution, it added. In keeping with Sebi guidelines, listed corporations must disclose any type of encumbrances inside seven days of inking such transactions.

Adani had acquired Ambuja and ACC for Rs 51,825 crore, or $6. 5 billion, of which 69% (about Rs 35,885 crore, or $4. 5 billion) was financed by way of overseas borrowings. His group had stated on September 16 that 14 worldwide banks had financed the transaction. The deal marked his foray into India’s cement sector and he plans to double the manufacturing capability of the cement enterprise to 140 million tonnes from 70 million tonnes by 2027. He’ll infuse a further Rs 20,001 crore into Ambuja by way of Harmonia Commerce and Funding — an affiliate of Endeavour — to speed up growth. In keeping with Jefferies, Adani will get entry to Ambuja and ACC’s $1. 4-billion money by way of the acquisition.

The pledge comes at a time when his dealmaking in an array of companies from inexperienced vitality to media raises issues over the excessive degree of debt throughout his Adani Group, Bloomberg reported. Whereas the enterprise has moved to curtail some pledges throughout its listed entities, different items proceed to have elevated leverage ratios that stand out amongst peer corporations globally, it stated.